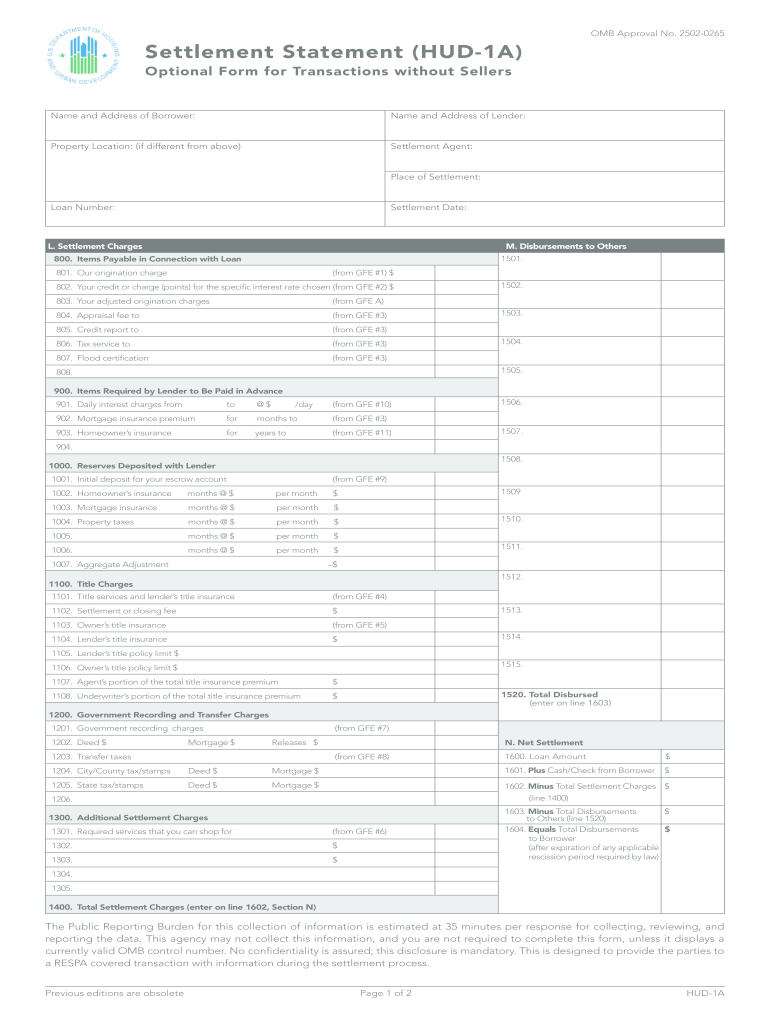

Who needs a HUD-1a Form?

The HUD-1A Settlement Statement is created by the US Department of Housing and Urban Affairs (HUD). The form is used in real estate transactions involving federal mortgage loans without a seller, such as the refinancing of real estate. It is also known as the Settlement Statement (HUD-1A) Optional Form for Transactions without Sellers.

When is the Settlement Statement Optional Form for Transactions without Sellers used?

Form HUD-1A is an important document required in case of transactions based on mortgage loans while there is no seller involved. Its aim is to communicate and capture all the details of such a transaction including settlement charges and loan terms.

What forms do the HUD-1A accompany?

Logically, as the given form serves as an optional form, it must always be filed as an attachment to Form HUD-1 (Settlement Statement). However, the HUD-1A does not necessarily have to be completed for all applications for a mortgage loan.

When is the HUD-1A Form due?

The agent who conducts the settlement should file the HUD-1A form at the moment the transaction is settled. It should be noted that the borrower in the transaction has the right to inspect the HUD-1 and the optional HUD-1A form one day before the date of settlement.

How do I fill out the HUD-1A Form?

The HUD-1A Form is a two-page table that should include the following information:

- General information about the transaction (the borrower, the lender, the property location, loan number)

- Settlement charges (payable items, what should be paid in advance, deposited reserves, title charges, etc.)

- Disbursement to others

- Comparison of GFE (Good Faith Estimate)

- Charges that can change

- Loan Terms, etc.

Where do I send Form HUD-1?

Two copies of the completed Form HUD-1A should be retained by the lender and the borrower.